Becoming a CPA has many benefits, including career advancement, higher-income opportunities, and more freedom to explore your favorite niches and specialties within the accounting and financial fields. buy Florida CPA Certificate, Each state has its own requirements for gaining the proper education and licenses to become a CPA. Florida’s CPA requirements are relatively simple, although you will need to dedicate your time and energy to completing certain educational programs and examinations.

The state of Florida requires CPAs to pass the American Institute of Certified Public Accountants (AICPA) Uniform CPA exam. To sit for the exam, you must meet Florida’s CPA education requirements.

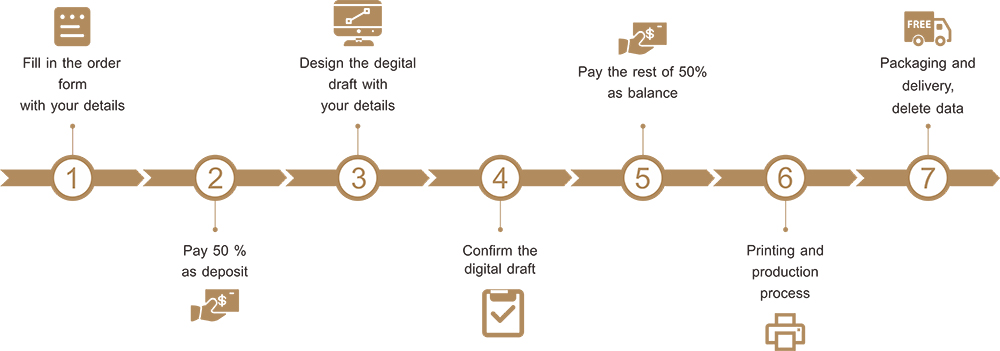

How to purchase a fake Florida CPA Certificate online?

The first step to becoming a CPA in Florida is to pursue the education requirements described above. You must complete your courses with an educational institute that is accredited by one of Florida’s approved accreditation organizations. If you meet the education requirements with a non-accredited school, you must fulfilll additional education requirements to validate your previous learning. This includes 15 semester hours of graduate classes from an accredited school, including nine semester hours of accounting (three of which must be focused on taxation).

After you meet your education requirements, you can begin completing your work experience. You must have at least one year of work experience in accounting, attestation, compilation, management advisory, financial advisory, tax, and consulting skills. Any work that you complete must be signed off by a licensed CPA.

To take the Uniform CPA exam, you must fill out the application with the Florida DBPR and pay a $50 fee. Then, you can contact the National Association of State Boards of Accountancy (NASBA) to schedule your exam date. The CPA exam has four sections that each take four hours to complete. You must pass all four sections within a rolling 18-month period.

Once you meet all of the education and work experience requirements, you can apply for your license thru the DBPR. You will have to provide evidence that you have met the requirements and pay a $50 application fee. You must apply for your license within three years of completing the Uniform CPA exam. You should receive your license in the mail within four to six weeks, although you might have access to a printable version earlier than that.